It’s always inspiring to learn about the success stories of individual traders.

Today, we’re taking a glimpse at two traders who have achieved one of the highest approved numbers of Payouts at Funded Engineer: Kyle Ng from the United States and Rowell Quek from Singapore.

In this blog, we’re going to explore their impressive payout figures and delve into some of their trade statistics.

Rowell Quek and Kyle Ng have shared their trading strategies and the mindset they apply to their trading which gives us a glimpse into the approaches that guide their decision-making in the markets.

Table of Contents

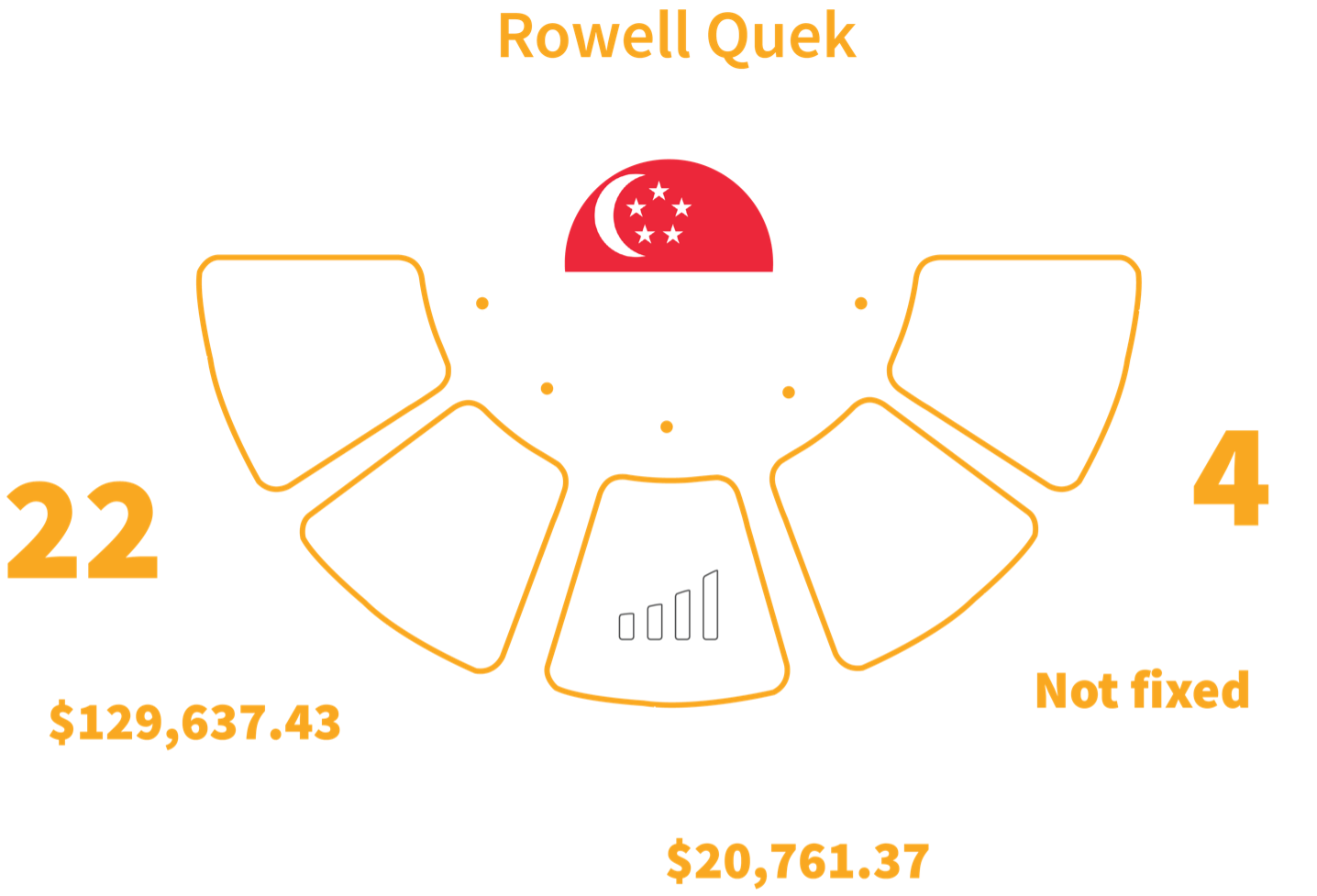

Rowell Quek – Top Trader Overview

Rowell Quek from Singapore stands out at Funded Engineer, showcasing remarkable trading skills.

With 22 total approved payouts in the last 20 weeks, she’s one of the most consistently profitable traders at Funded Engineer.

These payouts, amounting to $129,637.43, come from four simulated funded accounts across two programs, Standard Funded and Superior Funded.

Notably, her most significant single payout reached a substantial $20,761.37.

Kyle Ng – Top Trader Overview

Kyle Ng from the United States is another most consistently profitable trader at Funded Engineer.

Not far behind from Rowell Quek, Kyle has achieved 19 approved payouts in the last 20 weeks.

His total Payouts of $77,495.98 stem from his skilled handling of four simulated funded accounts within the Superior Funded Program.

Impressively, his largest single payout was a notable $16,277.72.

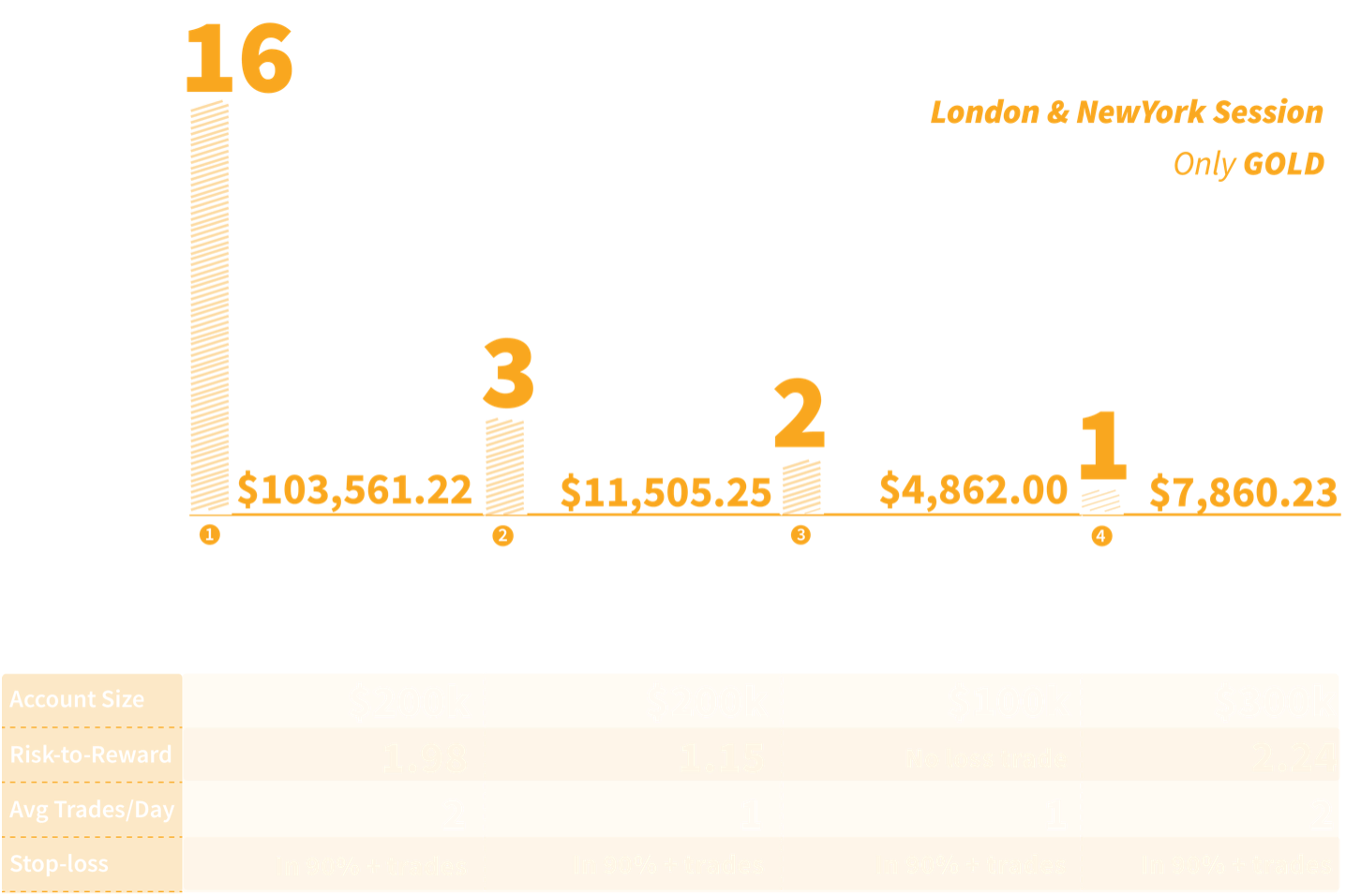

Rowell Quek – Trading Figures

Rowell Quek only focuses on trading Gold during the London and New York sessions.

She has achieved payouts from four different simulated funded accounts, with balances ranging from $100,000 to $300,000.

On average, Quek executes two trades per trading day, demonstrating her discipline and ability to manage emotions without overtrading.

Her trading strategy involves price action and Supply/Demand analysis across different timeframes.

Rowell Quek’s consistent use of stop-loss orders in over 90% of her trades shows her prudent risk management.

This strategic approach helps to minimize her potential losses, ensuring that even if a trade doesn’t go as planned, her overall capital isn’t significantly affected.

Her simulated trading accounts reflect an average risk-to-reward ratio of approximately 1:2.

Kyle Ng – Trading Figures

Kyle Ng trades in the New York trading session, focusing on major currency pairs such as EUR/USD, GBP/USD, and AUD/USD.

His impressive trading record boasts 19 approved payouts from four simulated superior funded accounts, with sizes ranging from $100,000 to $500,000. (500,000 account size is no longer offered at Funded Engineer)

His trading strategy involves using ICT concepts for Intraday and intraweek swings.

He focuses on process over performance targets, emphasizing consistency in rules and risk management which is underpinned by a consistent application of stop-loss orders in over 90% of his trades.

His risk-to-reward ratios vary from 1.42 to 2.48 and averages about 5 trades per trading day.

Now, let’s delve into the perspectives of Rowell and Kyle on their trading strategies.

Rowell Quek – Top Trader Strategies

“In trading, I’ve learned the importance of tailoring lot sizes to fit my account, which aids in risk management.

Controlling emotions remains a challenge; specifically, the reluctance to accept losses.

Trading is a journey of self-discovery and often an emotional roller coaster.

Stress is a constant companion, whether dealing with profits or losses.

Experience has taught me the value of small gains and the power of compounding.

While losing streaks happen, perseverance and trust in my skills and process are key. Like any discipline, consistency is critical in trading.

Showing up daily, just as one would in a sport, is essential. Patience is also crucial, especially in waiting for the right setups and not forcing trades to recover from losses.

Trading goes against natural human emotions, making it a continuous learning curve.

I wouldn’t consider myself a master of trading yet, as there’s always room for self-improvement. Many let the fear of failure restrain them, but it’s the unseen struggles behind success stories that forge resilience.

Surrendering to challenges is simple, but true growth comes from persevering and turning each setback into a learning opportunity.

Belief in oneself, continual learning, and progress are crucial to success. Embrace the journey, trust the process, and remember, it’s not the tough times but the tough people that last.”

Kyle NG – Top Trader Strategies

“Over time, my approach to risk management has improved.

I’ve found success in incrementally increasing my positions in trades that show clear direction on larger timeframes, starting with a single entry and expanding as the market moves in my favor.

I cap my risk at 0.25% per trade, avoiding exceeding 0.5% in total open risk. I’ve learned the importance of knowing when to increase trade sizes, especially during rare high-quality setups.

Full-time trading brings unique stress, and routine is my anchor. Bad streaks can disrupt, but stepping back to “touch grass” keeps my perspective.

Past hardships have been invaluable, teaching me to adhere to rules and risk management to avoid repeating those stressful times.

Now, I focus on fine-tuning my strategy for better profit maximization and drawdown reduction rather than overhauling my system.

Deliberate focus in one area at a time, especially on weaker aspects, enhances my trading performance more effectively than spreading my efforts too thinly.

I’ve refined my trading strategy to the point where only minor adjustments are necessary to enhance profits and decrease downtimes.

My system is stable, so I focus on perfecting my trade entries, exits, and stop-loss placements.

In terms of personal development, concentration on one aspect of trading at a time is key — be it technical analysis, risk management, or trading psychology.

Trying to improve all areas simultaneously can be counterproductive.

Instead, I prioritize areas that need the most improvement, as they can significantly impact overall performance.”

To Wrap up

We hope this blog has provided you with valuable insights that you can apply to your own trading strategies.

The dedication and discipline of Kyle and Rowell remind us that while the markets are demanding, the right approach and mindset can lead to remarkable outcomes.

As you reflect on their experiences, consider how their lessons can influence your trading journey.

Note: It’s important to note that the trade statistics featured in this blog were shared with the explicit consent of the traders involved. Funded Engineer respects the privacy of its traders and would not disclose such information without prior consent.