Candlestick patterns provide valuable insights into price fluctuations and market sentiment, aiding traders in making informed decisions.

In this blog post, we will explore the fundamentals of candlestick patterns, their components, and two popular bullish and bearish patterns that can assist you in assessing your trading bias.

By understanding these patterns, you can enhance your technical analysis and improve your trading strategies.

Let’s dive in!

Understanding Candlestick Patterns

Candlestick patterns are graphical representations of price movements over a specific time frame. They consist of three key elements: the body, the wick, and the color.

The body of the candle: The body of a candlestick represents the price range between the opening and closing prices during the given period. A long body suggests significant price movement, while a short body implies relatively small price changes.

The wick of the candle: The wick, also known as the shadow or tail, extends above and below the body of the candlestick. It reflects the highest and lowest prices reached during the time frame. Longer wicks indicate increased volatility, while shorter wicks signify more stability in prices.

The color of the candle: Candlesticks are traditionally depicted in two colors: bullish patterns (usually green or white) and bearish patterns (typically red or black). A green/white candle indicates that the closing price was higher than the opening price, representing bullish sentiment. Conversely, a red/black candle suggests bearish sentiment, signifying that the closing price was lower than the opening price.

Bullish Candlestick Patterns

Now, let’s focus on two easily identifiable bullish candlestick patterns that can indicate a potential price reversal:

The Hammer Candle: The hammer candle has a small body and a long lower shadow. It signifies that buyers overcame sellers by the end of the period. This pattern suggests a possible trend reversal from bearish to bullish.

The Bullish Engulfing Candle: The bullish engulfing pattern occurs when the body of the current candle fully engulfs the body of the previous candle. It indicates a shift in market sentiment towards bullishness as buyers dominate the trading session.

Bearish Candlestick Patterns

Similarly, we have two significant bearish candlestick patterns that can indicate a potential price reversal:

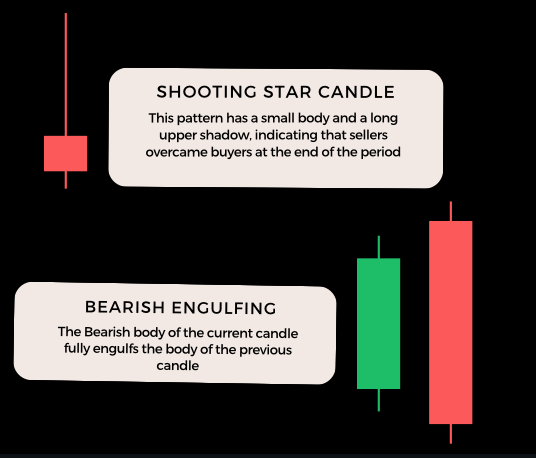

The Shooting Star Candle: The shooting star candle has a small body and a long upper shadow. It suggests that sellers overcame buyers by the end of the period. This pattern indicates a potential trend reversal from bullish to bearish.

The Bearish Engulfing Candle: The bearish engulfing pattern occurs when the bearish candle’s body fully engulfs the body of the previous bullish candle. It signifies a shift in market sentiment towards bearishness as sellers take control of the market.

How to use the hammer/shooting star & engulfing candles to trade price action

Remember that each trading approach has its own merits and aligns differently with traders’ preferences.

It is crucial to backtest different strategies and evaluate their performance to determine which approach suits your trading style the best.

You may choose to blend elements from different approaches or develop a customized strategy that suits your risk tolerance and objectives.

Let’s explore these strategies in detail:

Bullish or Bearish Engulfing

For the bullish or bearish engulfing pattern, there are two primary approaches to consider based on your trading style:

Aggressive Approach:

Execute a market order at the close of the engulfing candle. This approach aims to capture the immediate momentum shift in the market.

Conservative Approach:

Place a stop order at the extreme of the engulfing candle. By doing so, you can enter the trade in alignment with the market’s momentum. This approach offers a more cautious entry and reduces slippage risk.

If you prefer a cheaper entry point and want to increase your risk-to-reward ratio (R), you can wait for a short retracement to the Fibonacci within the range of the previous candle.

Hammer or Shooting Star

Similar to the engulfing pattern, the hammer or shooting star candlesticks offer both aggressive and conservative entry options:

Aggressive Approach:

Execute a market order at the close of the hammer or shooting star candle. This approach aims to capitalize on the immediate market reaction.

Conservative Approach:

Place a stop order at the extreme of the hammer or shooting star candle. By entering the trade in the direction of the market’s momentum, you can reduce the risk of entering too early.

If you prefer a safer approach, you can wait for the price to return into the hammer or shooting star pattern to confirm the price action. Then, place a limit order at the extreme of the candlestick.

This waiting period adds an extra layer of confirmation to your entry decision. An effective yet simple extra layer of confirmation using aggressive traders moving their position to breakeven to your advantage.

Applying Candlestick Patterns For Your Trading Strategy

It’s important to remember that candlestick patterns alone cannot guarantee an accurate trading strategy.

To make well-informed trading decisions, it’s recommended to combine candlestick patterns with other technical and fundamental analysis tools.

Seek confirmation from indicators or price action techniques, as this will help validate the reliability of the observed patterns.

Some Extra Points

Harnessing Technical Indicators for Enhanced Analysis

Just as candlestick patterns offer valuable insights into market sentiment and potential price movements, technical indicators serve as powerful tools for traders to analyze market dynamics. Explore a diverse range of technical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to complement your candlestick pattern analysis. Each indicator provides unique perspectives on price trends, momentum, and volatility, allowing you to confirm or validate signals generated by candlestick patterns. By integrating technical indicators into your analysis, you can gain a more comprehensive understanding of market conditions and make more informed trading decisions.

Embracing Price Action Strategies

In addition to candlestick patterns and technical indicators, price action strategies offer traders a nuanced approach to interpreting market behavior. Price action analysis focuses on studying raw price movements and chart patterns without the use of indicators or oscillators. By observing how prices interact with support and resistance levels, trendlines, and chart patterns such as triangles and flags, traders can identify high-probability trading opportunities and anticipate potential price reversals or continuations. Embracing price action strategies alongside candlestick pattern analysis empowers traders to develop a deeper understanding of market dynamics and enhance their ability to capitalize on favorable trading setups.

Conclusion

Candlestick patterns and price action entries provide valuable insights for traders.

By understanding different entry confirmations, you can develop effective strategies to capitalize on market opportunities.

Whether you opt for aggressive execution to catch immediate momentum or prefer a more conservative approach to reduce risk, it’s important to backtest and fine-tune your chosen strategy.

Remember, patience and discipline are key in implementing successful entry techniques.